Shaun Boyd is Your Political Reporter at CBS News Colorado. Share you story ideas with her by sending an email to sboyd@cbs.com or yourreporter@cbs.com.

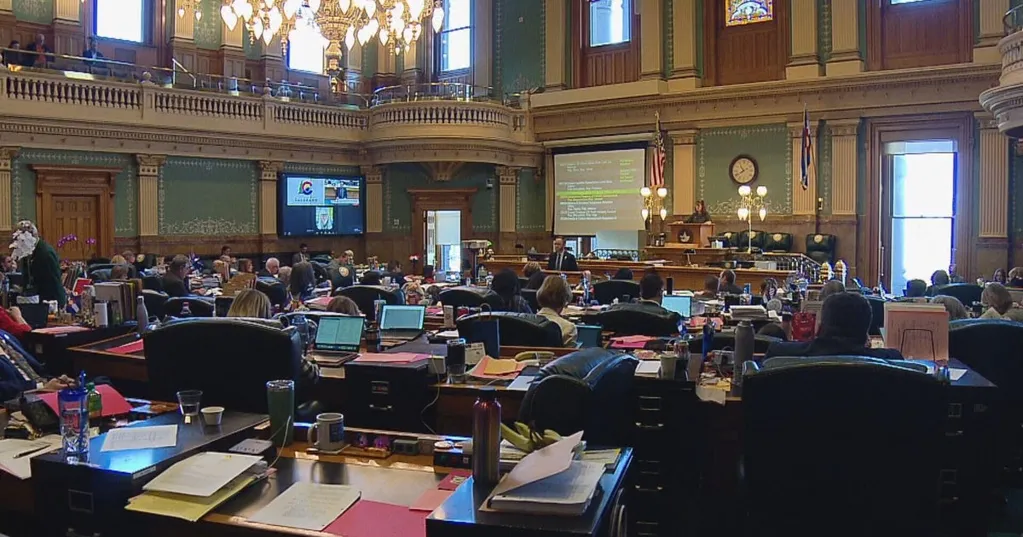

Colorado lawmakers head back to the Capitol on Thursday for a special session, and many are divided on how to address the budget shortfall.

They need to come up with $750 million to cover this year's expenditures after the passage of President Trump's "Big Beautiful Bill". The bill lowered taxes for businesses and individuals, resulting in less revenue for Colorado, which is one of only four states that use federal taxable income to determine how much people pay in state taxes.

Lawmakers have already filed more than two dozen bills, but they are limited in scope. Gov. Jared Polis sets the parameters for the special session, and since the law allows him to decide what to cut, he directed lawmakers to increase tax revenue. But the two parties have very different ideas for how to do that.

"The number one thing we are looking at is closing corporate tax loopholes," said Democratic Representative Yara Zokaie of Fort Collins.

Democrats plan to roll back up to $400 million in business tax breaks, including a $70 million a year incentive for insurance companies to establish regional home offices here.

"When we are talking about taking money from working families and, quite literally, food out of the mouths of children, food stamps are on the line here, I think it is completely unethical for us to say the insurance industry deserves money instead," said Zokaie.

Carol Walker with the Rocky Mountain Insurance Information Association says the bill could cost the state thousands of jobs, "This is just another signal to the insurance industry that they really aren't welcome in the state, and those jobs don't mean anything."

Democrats are also expected to impose up to $100 million in new fees on health insurers to offset cuts to federal subsidies for low-income Coloradans, and they plan to end a tax break meant to compensate businesses for sales tax collection.

Nick Hoover with the Colorado Restaurant Association says restaurants will be hit hard. "The problem is that it's death by a thousand cuts. This is just yet another thing that's going to be another cost that is going to be increased for the restaurant industry."

Republican Senator Barb Kirkmeyer says the state needs to cut spending, not increase taxes. "The federal government gave us tax relief, and the state Democrats' answer is we've got to increase your taxes now."

Kirkmeyer says the state could absorb almost all the lost revenue by changing a program meant to lower the tax liability of families that make under $95,000 a year.

The Department of Revenue says about 230,000 families have received more money than they owe in taxes, $663 million more. Under a bill by Kirkmeyer, the state would cover the tax liability only, "to make sure we have the funds to spend on what are core functions of government; K-12 education, healthcare,public safety;those types of things;roads."

Zochaie says the two parties have a difference of priorities: "It does not surprise me that Republicans are once again looking to take from working families in order to pad the pockets of billionaires."

Kirkmeyer says Democrats should do what the Taxpayer Bill of Rights (TABOR) requires and let voters decide on changes to tax policy: "If they're so sure of their scheme, why don't they put it to a vote?"

Lawmakers are also expected to use about $300 million from the state reserve to cover the shortfall.

In addition to bills dealing with the budget, there are four bills addressing a controversial artificial intelligence law set to kick in in February, as well as several bills regarding funding for food stamps and Planned Parenthood.

The special session is expected to last up to a week.