WASHINGTON, Dec 8 -- China's retaliatory export controls could take a toll on the growing US clean energy sector and its defence industry, analysts say, as a trade tussle escalates between the world's two biggest economies.

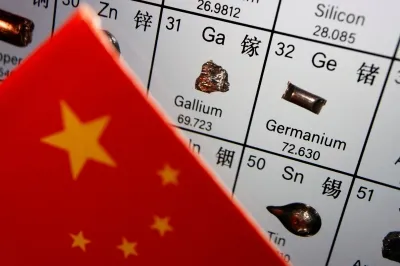

Beijing announced this week it would ban exports of gallium, germanium and antimony to the United States, targeting materials used for everything from semiconductors to solar cells. China also tightened restrictions on graphite, which is key to the electric vehicle industry.

The moves, which Beijing said were to safeguard national security, swiftly followed Washington's own curbs to hobble China's ability to make advanced computer chips. While trade tensions have been simmering, US President-elect Donald Trump's arrival at the White House in January is likely to ratchet up the temperature on trade -- with the Republican already vowing sweeping tariffs on Chinese imports.

"This certainly could drive up costs," said Arun Seraphin of the National Defence Industrial Association. "It could create situations where you can't produce what you need."

"It's certainly going to drive a lot of uncertainty for companies who want to plan out their supply chain," he told AFP.

China is a major producer of the three metals in question. In August, it unveiled export controls on some antimony products and since then, shipments have plunged. Restrictions announced in 2023 on gallium and germanium also hit exports to the United States.

Defence tech

"Gallium, germanium, and antimony are vital inputs for defence technologies," said Gracelin Baskaran and Meredith Schwartz of the Centre for Strategic and International Studies (CSIS) in a recent analysis.

Gallium and germanium are increasingly preferred over traditional silicon for high-performance chips used in defence applications, CSIS added. It noted these materials have properties that boost device performance, speed, and energy efficiency. Antimony is used in fireproofing and has defence-related uses too.

"Bans on vital mineral inputs will only further allow China to outpace the United States in building these capabilities," it said.

The US Geological Survey estimates that if China's net exports of gallium and germanium were completely restricted simultaneously, US GDP could decrease by US$3.4 billion (RM15 billion).

Challenges

Besides defence applications, gallium-based semiconductors are used in radio frequency electronics, LEDs for lighting and high-efficiency solar cells. Although gasoline vehicles do not call for graphite, electric vehicles (EVs) require an average of 136 pounds (61.7 kilogrammes) of the material according to CSIS.

This situation poses challenges for the United States as it has spurred billions in private sector investments for its domestic EV supply chain through subsidies via the Inflation Reduction Act—a package under President Joe Biden focusing on energy transition policy and social reforms.

"The industry was likely somewhat surprised by the swiftness of imposing a broader ban but has been conditioned over time," Paul Triolo of Albright Stonebridge Group told AFP.

He noted that China's commerce ministry had already implemented a licensing regime around these key minerals including "rolling three-month licenses" aimed at preventing stockpile accumulation.