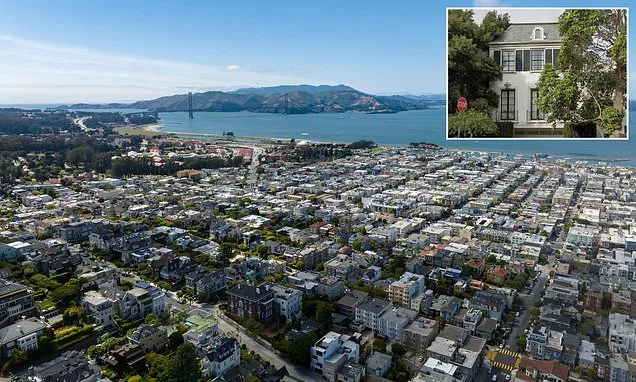

The coastal city of San Francisco is struggling to keep up with the mass of newly-minted millionaires flocking to snatch up mansions as artificial intelligence booms.

With newly-wealthy tech workers looking to buy homes in the city, the ritzy neighborhood of Pacific Heights is among one of many finding their luxury housing market stock is dwindling faster than ever.

One luxury broker said that one 5,000-square-foot mansion in the area sat idly waiting to be snatched up in 2017.

But a sudden surge in buyers is now moving the market along quickly, with the same 1994 Jackson St. home going up for sale again and this time selling on day one.

'It was a difficult house at the time,' Peter Rodway, senior partner at Neal Ward Properties, told the San Francisco Chronicle.

'This time, buyers were banging at the doors to get into it. An offer came in on the first day, at full price.'

The luxury home sold for $9.4 million last month and served as just one example of the quickly changing market in San Francisco that has left many real estate brokers baffled.

As the AI industry booms in the city, San Francisco has become the epicenter of an ever-increasing wealth gap that's only becoming worse with new money home buyers entering the picture.

Luxury home sales are up by 14 percent year-over-year in San Francisco, while inventory is down by around 4.5 percent annually.

AI employees are flocking to the city to be closer to their workplaces after companies, such as ChatGPT's creators OpenAI, set up their headquarters in downtown San Francisco - which has been described as a 'magnet' for tech firms.

The Bay Area also became home to Meta's Menlo Park Campus, and many other AI-tech companies have laid foundations in the city that sits just around an hour away from Silicon Valley.

In September, Anthropic - founded in 2021 by former OpenAI researchers - leased two floors in downtown San Francisco.

Around 83 AI companies have leased nearly a million square feet of office space in the city, The San Francisco Standard reported.

Former Uber executive and serial entrepreneur Chris Saad told the outlet: 'If you want to make a blockbuster movie, you go to LA, and if you want to build a blockbuster startup, you go to San Francisco and Silicon Valley.'

Sotheby's Chief Marketing Officer Bradley Nelson told Bloomberg that San Francisco and Silicon Valley have become the epicenter of the AI-boom.

Companies in the industry have also offered up tender offers, which gives employees and investors a chance to sell a portion of their shares, allowing more opportunity for them to put their funds into higher-priced housing.

Nelson told the outlet that this company strategy is done 'to quell internal pressure to go public.'

He added that 'more homes sold above $20 million in San Francisco in 2024 than in any other year in history.'

Agents are noting how the increase in demand with a lack of supply is evidencing that the city is becoming more of a seller's market, as sales occur more frequently and close more quickly.

Overall home sales in San Francisco surged by 35 percent year-over-year.

Thus, agents have seen luxury housing demand skyrocket, but many are finding the increase in demand is leaving the top of the luxury market sparse.

'The city is just flush with cash right now - and there's not enough inventory to keep up with it,' Rodway said.

While home prices appear to have remained steady so far, according to data from Zillow, it may not last for long.

As of July, median sale prices sat at around $1,420,000, almost $300,000 more than the median listing price, data showed. The city saw 60.7 percent in sales over listing price.

Agents are noting how the increase in demand with a lack of supply is evidencing that the city is becoming more of a seller's market, as sales occur more frequently and close more quickly.

Luxury home sales are up by 14 percent year-over-year in San Francisco, while inventory is down by around 4.5 percent annually, the Chronicle reported.

Buyers are not only scooping up million dollar homes at increasing rates, but also proving that money appears to be no object.

Nina Hatvany, a luxury real estate agent with Compass, told the Chronicle that luxury home sales are becoming 'a bit of a bloodbath.'

'It's very hard to win in the competitive bidding situations that we're seeing. Things are getting scooped up, and for hundreds of thousands of dollars over asking,' Hatvany said.

'As we get higher, we have listings in the $10 million range that are now getting scooped up, they are finally starting to move.'

Gregg Lynn of Sotheby's further told the outlet that driving factors include tech-employees and families looking for larger homes.

'We've always had a mansion shortage in San Francisco. The problem is, for the past three years, we've also had a buyer shortage. But, now the buyers are back,' he said.

But apart from anything, agents are concerned that the shortage and influx of buyers has only just begun.

Dhar added that 'these companies literally just started.'

'It's more likely than not that we're at the very first year or two of one of these San Francisco eight-to-ten-year gold rushes than we are towards the end. My feeling is: This is just the beginning,' Dhar continued.