The wave of tax refunds coming Americans' way in 2026 could be much larger than usual after the Trump administration said this month that Americans should expect to receive an additional $1,000 in their refund next year.

Extra money in your tax refund could provide millions of Americans with an extra boost in disposable income in early 2026.

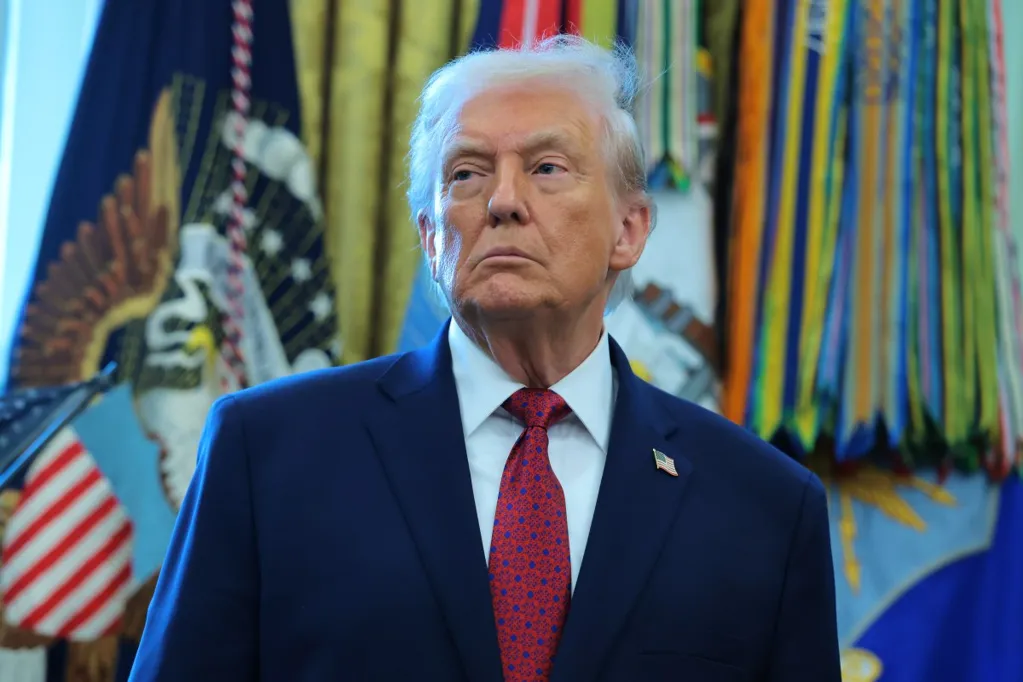

President Donald Trump's tax legislation, the One Big Beautiful Bill Act, became law in July and made considerable shifts to the tax landscape.

White House press secretary Karoline Leavitt said earlier this month that "Americans can expect another boost in their bank accounts in the months ahead."

She also said that 2026 tax refunds are "projected to be the largest ever thanks to President [Donald] Trump's passage of the One Big Beautiful Bill."

"It is only because of President Trump and Republican leadership that Americans will now pay no tax on tips, overtime, and Social Security," Leavitt said.

This echoes Treasury Secretary Scott Bessent's statement that working Americans would get "very large refunds" next year, translating to about $1,000 to $2,000 per household, courtesy of tax cuts under Trump's legislation.

"I think we're going to see $100-$150 billion of refunds, which could be between $1,000, $2,000 per household," he told reporters this month.

Meanwhile, a new report from the Tax Foundation found that the One Big Beautiful Bill Act could raise the average 2026 tax refund to about $3,800, up from $3,052 in 2025. The act specifically introduced a larger standard deduction, an increase in the child tax credit from $2,000 to $2,200, and significant benefits for business owners through expanded bonus depreciation.

"For many households, that should translate into a higher refund. That said, it's all relative. Higher refunds don't necessarily mean more purchasing power, as costs remain elevated across key categories like health insurance, auto insurance, and the broader cost of living," Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek.

"Trump was instrumental in getting this bill across the finish line. The major caveat most people overlook is on the revenue side. Tax revenue is the government's primary source of income, and provisions like these mean less money coming in while spending continues to move out the door. That imbalance is the part worth paying attention to."

The White House said in an X post on December 4: "Largest tax refund season in American history. Thanks to extended tax cuts and retroactive tax relief provided by the Working Family Tax Cuts."

Treasury Secretary Scott Bessent told reporters this month: "The bill was passed in July; working Americans didn't change their withholding, so they're going to be getting very large refunds in the first quarter. So I think we're going to see $100-$150 billion of refunds which could be between $1,000-$2,000 per household. Then, they'll change their withholding, and they'll get a real increase in their wages."

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: "While some may look at the promises of massive tax refunds coming to many American households being yet another bombastic claim that can't be backed up, the reality is the majority of tax filers will see a boost this coming year due to the changes being implemented through the One Big Beautiful Bill Act. Many employers don't adjust their paycheck distribution mid-year to reflect changes to tax code that have just taken effect. The result is any alterations made through the act that could benefit taxpayers will be more prominent in their refunds."

Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek: "The 'yuge' refunds everyone's talking about aren't really new tax cuts. They're the result of the IRS never updating withholding tables after the bill passed in July. People kept having taxes pulled from paychecks at the old rates all year. Now they're getting huge 'refunds' in spring 2026.

"Yes, the tax cuts are real. $144 billion in actual reductions for 2025. Higher standard deduction; no tax on tips; child tax credits bumped up. But the way it's being delivered creates this optical illusion of free money."

Americans must file taxes before April 15, 2026, and their tax refunds will generally arrive within just weeks of filing.

"Obviously, any additional money that individuals and families will see is good news, but how much a taxpayer receives will depend on what their income level is, among other factors," Beene said.