Washington's dirtiest secret is now out of the bag and may become a real headache for lawmakers who look to ignore voter fury over their tendency to rake in profits from the stock market.

In addition to their day jobs legislating and providing for their constituents - a tall task for making a measly $174,000 annual salary they say - many lawmakers on both sides of the aisle have active stock portfolios.

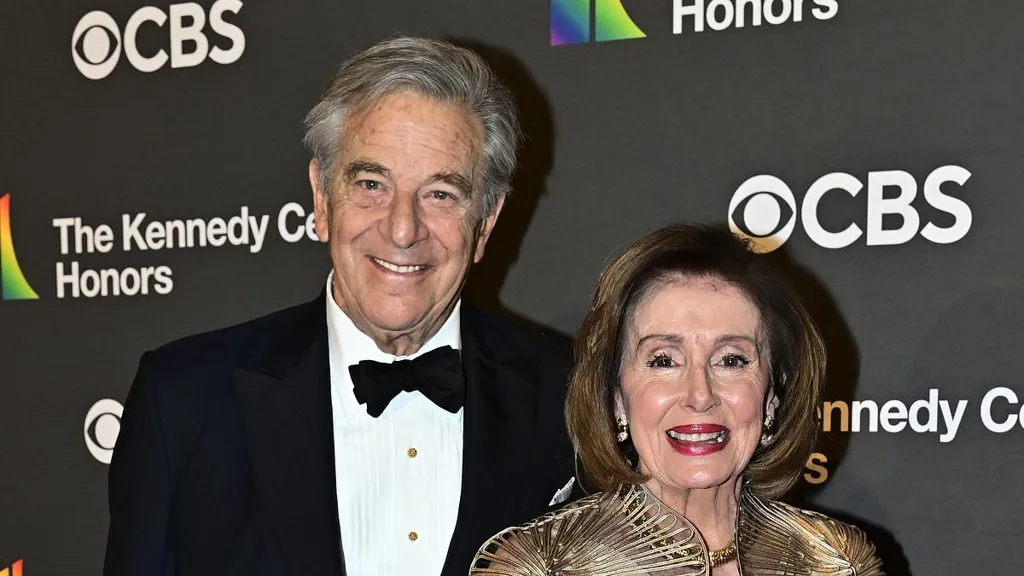

Most famous of all the politico profiteers is former House Speaker Nancy Pelosi, whose net worth, according to estimates from congressional money tracker Quiver Quantitative, has doubled over the last decade to a whopping $245 million.

Though her federally mandated stock receipts are filed under her spouse, Paul Pelosi, a Silicon Valley venture capitalist, the size of the estimated profits, well over $100 million in the last decade alone, have raised eyebrows, to say the least.

Paul Pelosi has a knack for making very successful options trades in big tech companies like Apple, Nvidia, Tesla and more right before the stocks skyrocket. Earlier this year, for example, he made over $38 million worth of trades, according to federal filings.

Notably when Pelosi was the most powerful member of Congress she neglected to put measures that could ban congressional stock trading on the floor for a vote, arguing that 'we're a free market economy,' and lawmakers 'should be able to participate in that.'

On the other side of the aisle former Sen. Richard Burr, R-N.C., also got into hot water when he dumped over $1.7 million in stock just ahead of the COVID-19 pandemic as he was privy to confidential information. After an investigation into the suspicious trade, the Justice Department opted against prosecuting Burr, he told reporters at the time.

But as the question has simmered for years, and as more scrutiny has been drawn to the matter thanks to congressional trading trackers like Quiver and others, a new bipartisan push to ban members from profiting off their inside info is rapidly gaining steam - and it may become a top issue in the 2026 midterms.

Paul Pelosi has been a prolific trader since his wife has been in Congress. Many of his transactions on tech stocks have caused some online to question his incredibly timed trades.

Sen. Josh Hawley, R-Mo., introduced a bipartisan measure last year to ban members of Congress from trading stocks.

'We built out a dashboard that lets you track politicians' portfolios back in 2020, and have had a front-row seat as attention towards the issue has grown over time,' Chris Kardatzke, co-founder of Quiver Quantitative, told DailyMail.com in a statement.

His website originally had just a few visitors per month, he said,but recently his congressional money tracking site is getting hundreds of thousands of visitors monthly.

And with the explosive interest in congressional stock trading in recent years the support for a ban on the practice has grown.

'When we first released the dashboard, around 67 percent of Americans supported a ban on congressional stock trading,' he shared.

'Polls now show 86 percent in favor, with overwhelming bipartisan support among voters.'

'This hasn't yet resulted in any new legislation getting passed (there doesn't seem to be the same overwhelming bipartisan support among elected officials) but there appear to be signs of potential progress,' Kardatzke said.

Current regulations under the STOCK Act simply require members to disclose their trades within 45 days of making them, though the cash penalty for late reporting is just pennies on the dollar as the measure doesn't require a fixed price fine.

The law also prohibits members from using information gleaned from their work to their advantage in the markets, though this is nearly impossible to enforce.

Recognizing this as an unfair advantage, a number of younger lawmakers have introduced measures to ban stock trading among members of Congress in the last few years.

In fact, a bill that would ban stock trading among members made it out of committee for the first time ever last year.

'Two of the largest proponents were Senator Josh Hawley and Senator Jon Ossoff - both widely regarded as influential up-and-comers in their respective parties,' Kardatzke noted.

'Representative Seth Magaziner introduced a new ban bill in the House in January which already has 65 cosponsors - including over a dozen Republicans,' he continued.

The push to ban trading is growing in popularity among Democrats too especially after Georgia Republican Marjorie Taylor Greene caught headlines earlier this month for making major trades right before Trump announced his sweeping tariff regime.

House Minority Leader Hakeem Jeffries said in a post this week its time to ban stock trading amongst members of Congress

Jeffries post specifically highlighted an article about Rep. Marjorie Taylor Greene's stock trades around the time Trump backed off his tariffs and stock prices went rocketing up

Trump's warning on Truth Social that it was 'great time to buy' just hours before he reversed course on tariffs and sent stocks soaring has been seen as 'stock manipulation' by lawmakers on the left.

'It's time to ban stock trading by sitting Members of Congress and hold these crooks, liars & frauds accountable,' Jeffries wrote on instagram alongside a picture of a New York Times article noting MTG's flurry of stock trades around the time the president announced his tariff plans.'

His post this week may galvanize a wider push to pass legislation to ban the practice, like Maganizer's proposal.

Though as time has shown again and again, talking about a ban is easier than enacting one, and many lawmakers on the left and right who have their hand in the proverbial cookie jar may not be as inclined to stop feasting on its riches any time soon.