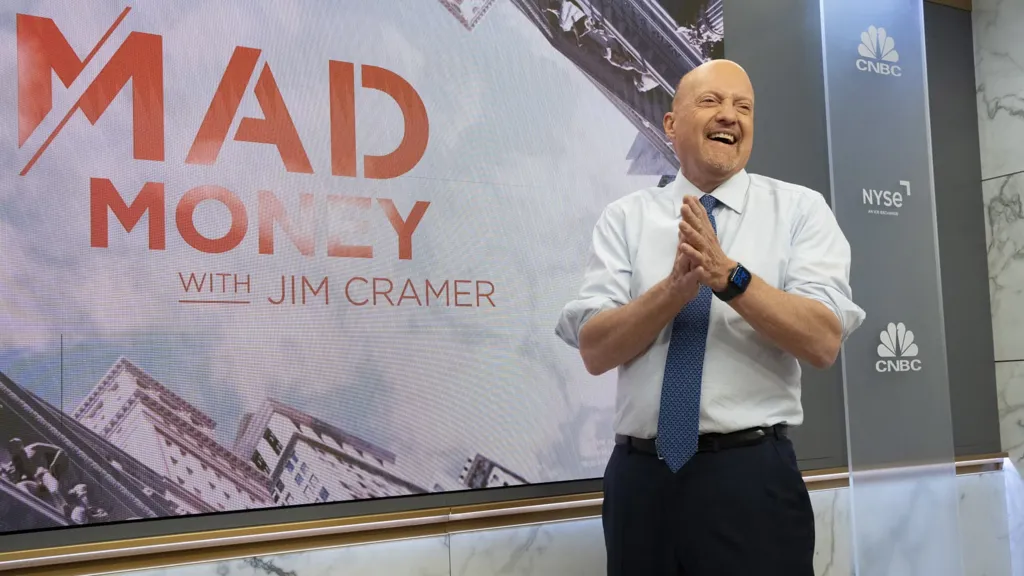

CNBC's Jim Cramer reviewed Wednesday's market action and told investors that he thinks removing Federal Reserve Chair Jerome Powell would not be a wise move from President Donald Trump.

"I hope today is the last day that Trump goes after Jay Powell, whose term ends in ten months anyway," he said. "Gunning for Powell will only hurt Trump, the same way it hurts the markets, and I don't think the President's a masochist."

Wednesday saw a volatile session as Wall Street worried Trump would fire Powell following reports he was planning to do so. But the Dow Jones Industrial Average managed to gain 0.53%, the S&P 500 rose 0.32% and the Nasdaq Composite added 0.26%. Trump has repeatedly relayed harsh criticism of Powell, angered that the Fed chair has so far chosen not to cut interest rates. Powell has expressed a commitment to keeping inflation in check and has said the central bank will likely hold rates steady until the pricing impact of Trump's steep global tariffs is more clear.

Trump denied he plans to remove Powell from office, calling it "highly unlikely." But a senior White House official suggested otherwise. The official, who spoke to CNBC on the condition of anonymity, said Trump asked a group of House Republicans if he should fire the Fed Chief and then stated he would after the lawmakers expressed support for the move. A Wednesday report from the New York Times claimed the president had actually shown House Republicans a draft of a letter to terminate Powell.

According to Cramer, the market's performance on Wednesday indicates that investors currently feel Trump would be wrong to fire Powell. Cramer weighed the reasons for and against cutting rates, saying those who favor imminent cuts believe the economy is slowing down. Wednesday's cooler-than-expected producer price index might be one reason to justify a rate cut, he added.

However, Cramer said Tuesday's consumer price index report shows that there are signs of inflation, including higher prices for clothing, furniture and food items, some of which he said could be due to the tariffs. But Cramer emphasized that there is still much uncertainty around how high tariffs will go and where Trump might target next. He also said that big banks who have reported earnings over the last few days haven't indicated that the consumer is hurting, and he added that the job market remains strong.

Cramer suggested Powell "has absolutely no reason to cut other than to stop the heckling."

"What's in it for President Trump if he tries to fire Powell? I think we saw it today: nothing," Cramer said. "The stock market would get rocked. Long-term interest rates would rise. What president would want that to happen? If I were president Trump, I'd wait to see what happens with his tariffs. As long as inflation's stable, two-and-a-half months from now, then by all means, bash Powell for refusing to cut rates."

When asked for comment, the White House pointed CNBC to Trump's Wednesday remarks.

"We're not planning on doing it," he said from the Oval Office. "I don't rule out anything," he added, "but I think it's highly unlikely, unless he has to leave for fraud."