You're reading The Readout newsletter.

You're reading The Readout newsletter.

You're reading The Readout newsletter.

Subscribe below to wrap up every weekday with essential insight on the stories that matter to the UK.

Subscribe below to wrap up every weekday with essential insight on the stories that matter to the UK.

Subscribe below to wrap up every weekday with essential insight on the stories that matter to the UK.

Bloomberg may send me offers and promotions.

By submitting my information, I agree to the Privacy Policy and Terms of Service.

Spare a thought for pound sterling. Little more than a week ago it was riding high at $1.385, a peak not seen since 2021. Now, however, at the time of writing, it is down three cents to $1.354 -- among the worst-performing major currencies.

What a fall from grace.

The move is due to some international factors, including Donald Trump's nomination of Kevin Warsh as Federal Reserve chair, but today the currency has been weighed down by two very domestic events.

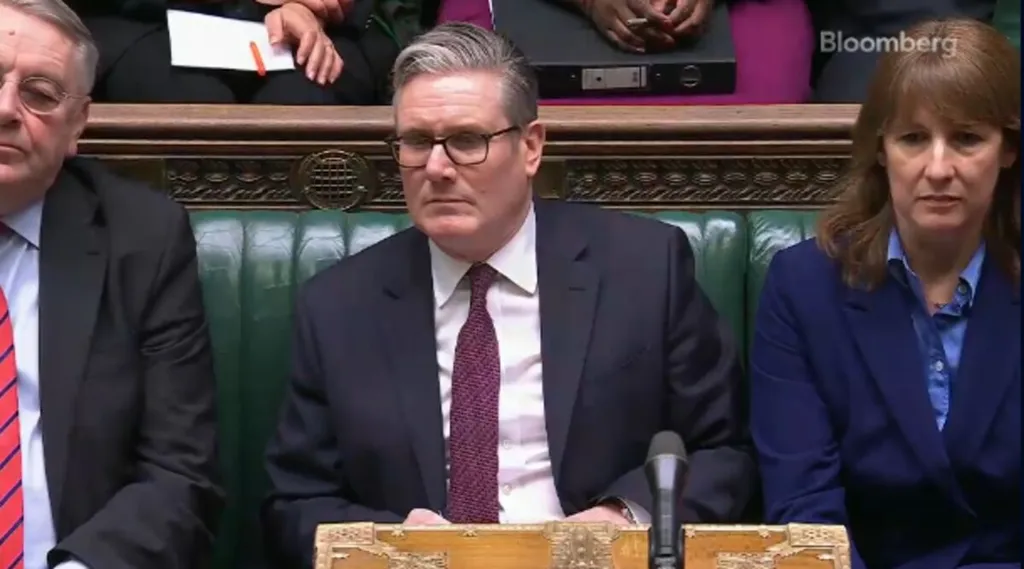

The first concerns another fall from grace, at least if you consider Peter Mandelson's career to have ever been graceful. The stain of his appointment as ambassador to the US is threatening Keir Starmer's leadership to such an extent that markets have priced in the risk of a more left-wing, free-spending Labour prime minister coming to power.

This morning, Starmer personally apologised to victims of the deceased sex offender Jeffrey Epstein, whose friendship with Mandelson has been particularly exposed. It was all Starmer could do, really, amid a volley of criticism of his judgement.

Sympathy for the prime minister is in short supply, although housing secretary Steve Reed did a valiant job of defending his boss on breakfast radio. Starmer loyalists clearly want to say: “Look, what was he supposed to do, faced with four years of MAGA across the pond? We had to get a trade deal out of a president who loves tariffs! We had to make Trump like us! Only Mandelson had the connections, experience and pragmatism to do this.” But of course, they don’t have the luxury of being quite so blunt.

Among the many public figures expressing their dismay at Mandelson’s actions in government was, a little surprisingly, Andrew Bailey. The Bank of England governor normally insists he can’t comment on political matters, but he made an exception for the scandal of the day.

“How is it that we live in a society in which this happened, while the cover-up happened as well,” Bailey said. “I think that is a very fundamental question that we have to ask ourselves.”

The governor looked emotional as he reflected how Mandelson may have been leaking information while working alongside Alistair Darling, the chancellor who Bailey said had acted with utmost integrity as he strove to protect Britain from the fallout of the financial crisis. Darling died just over two years ago.

Baily was speaking after his Bank came pretty close to delivering what would have been an entirely unexpected cut to interest rates at noon. Four members voted for a cut, while a few others -- including Bailey -- sounded close to being convinced, too. The prospect of lower rates was, therefore, the second domestic factor that helped drive the pound down.

The Monetary Policy Committee can now relax for six weeks before the spotlight shines on it again, when markets think there's more than a 50% chance of a March rate cut. That would knock the pound further -- but in the meantime it may come under even more pressure from events in Westminster.

What just happened

The stories you need to know about this evening

Markets Today: Dovish Tilt

The Bank of England's decision today came as no surprise. Pretty much every economist surveyed -- plus the market -- had expected the central bank to stand pat at 3.75%. The unexpected element was how close that call was. Most had expected a 7-2 vote, clearly in favour of a hold. In the event, there was only one vote in it, with Andrew Bailey narrowly swinging the decision away from a cut.

What does that mean for markets?

The dovish tilt hadn't been priced in. Traders ramped up their bets on the likelihood of a reduction coming in the spring (there's now more than a 90% chance priced in of a cut coming by April, with more than 60% odds of it coming in March). That's pulled down yields on shorter dated gilts as much as nine basis points, the most since November.

And the pound's fallen below $1.36, to the lowest level in a fortnight. Still, Bailey stressed that market movements earlier in the day had been "entirely orderly."

Behind the bank's decision today was an ahead-of-target forecast for inflation returning to its 2% target, with slowing wage growth and rising unemployment. For Bailey's vote to be swung, as well as fellow hold-voter Catherine Mann, more evidence is needed, but it seems for now they are getting ready.

The big number

108,400

The Bank of England raised its unemployment forecast to 5.3% -- which my number-crunching colleagues tell me is equivalent of 108,400 more people joining the dole queue.

The Big Take

One key story, every weekday

Japan's 'Lone Wolf' Seeks Election Mandate to Go Bold on Spending and China

Voters look set to back Prime Minister Sanae Takaichi's vision of a more assertive Japan. Markets are wary.

More from Bloomberg

- Enjoying The Readout? Check out these newsletters:

- * Markets Daily for what's moving in stocks, bonds, FX and commodities

- * Odd Lots for exploring the most interesting topics in finance, markets and economics

- * Money Distilled for John Stepek's daily newsletter on what market moves mean for your money

- * The London Rush for getting briefed ahead of your morning calls

- You have exclusive access to other subscriber-only newsletters.