Forbes contributors publish independent expert analyses and insights.

When President Trump came out for "No tax on tips" during the election campaign, I analyzed two legislative proposals towards that end that were in Congress. So when it came time for me to read the tax provisions of the One Big Beautiful Bill Act that is where I focused a lot of attention. You can find it on page 247 at the head of Chapter 2 (Delivering On Presidential Priorities To Provide New Middle-Class Tax Relief) - Bill Section 70201 - No Tax On Tips, if you want to follow along. In general, I find the provision very well thought out, except for one very odd thing. There appears to be a marriage penalty for well tipped servers tying the knot with one another and a marriage bonus for well tipped servers marrying industrious blue collar workers.

The provision adds Section 224 to the Internal Revenue Code which allows a deduction for "qualified tips". The deduction is limited to $25,000. The deduction is phased out starting at $150,000 of modified adjusted gross income (MAGI), $300,000 in the case of joint returns. The phase-out rate is $100 per $1,000 of MAGI. The "modifications" that are added are for income excluded because it was earned by working abroad, in US possessions or Puerto Rico. The deduction is not an itemized deduction. You will be able to claim the standard deduction on top of it. If married you have to file a joint return to claim the deduction.

Section 225 adds a deduction for qualified overtime compensation. That deduction is $12,500 or $25,000 in the case of a joint return. The phase-out is the same as for the tip deduction. As with the tip deduction married people have to file jointly in order to claim it. Why is the tip deduction limit $25,000 while the overtime deduction limit is either $12,500 or $25,000 depending on whether it is a joint return? I don't know and as a planner I follow Reilly's First Law of Tax Planning - It is what it is. Deal with it.

There are five high school friends who get together. They are not married but are thinking about it. They each make about $100,000 per year; Robin and Terry are servers in a pricey restaurant. Most of their income is from tips. Blynn and Ashley are electricians who work a lot of overtime, well above the average. Jesse is an enrolled agent.

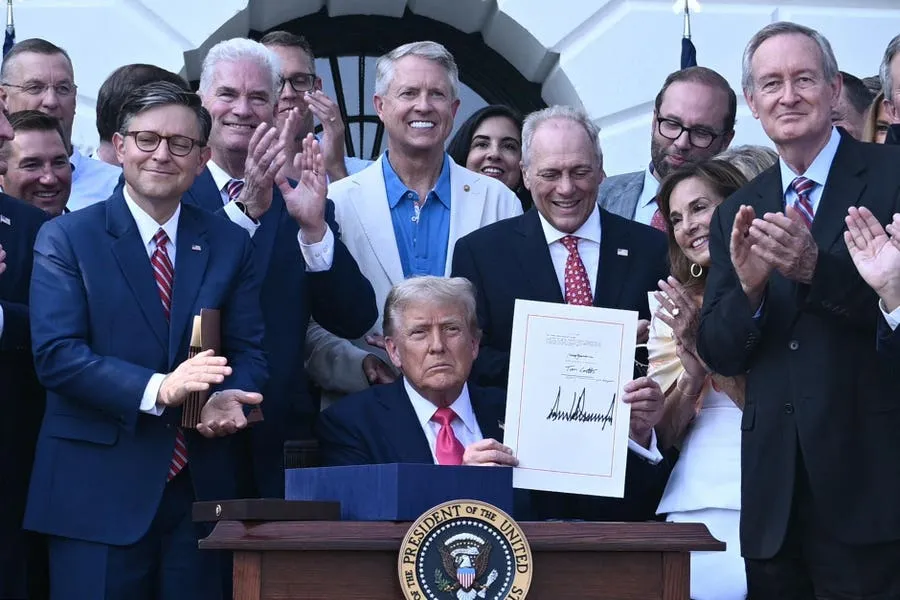

They get together to celebrate the Big Beautiful Bill. Robin and Terry want to know how much no tax on tips is going to save them and Blynn and Ashley are of course interested in the effect of no tax on overtime. It is up to Jesse to explain to them that that is not how it worked out in the Senate. It was converted to a deduction and there is a limitation. Remember they are all single. Jesse makes a big point of that because Jesse is a bit on the pedantic side.

Robin and Terry will each get a $25,000 deduction. Blynn and Ashley will each get a $12,500 deduction. Jesse, of course, gets nothing other than a lot of aggravation. Not that anybody would care about this, but the whole crew will be getting $75,000 in deductions. Since Jesse made such a big deal about them being single, the question of what happens if they get married comes up. And this is where it gets weird.

If Robin and Terry get married their deduction drops to $25,000. If Blynn and Ashley marry they get $25,000 on their joint return. So the whole crew now gets $50,000 in deductions - a marriage penalty. But what if Robin marries Blynn and Terry marries Ashley? Now both couples get $50,000 in deductions or $100,000 for the whole crew - a marriage bonus.

A lot of thought seems to have gone into the tips deduction and I think the details of that are worthy of a separate post. For now I will refer you to Reilly's Third Law of Tax Planning - Any clever idea that pops into your probably has (or will have) a corresponding rule that makes it not work. The statute seems to address many of the ways people might try to game the system.

The difference in the limit on tips and overtime for single people, but not married people strikes me as possibly unintentional particularly since the phase-our language is identical. The original House bill did not include any limit at all, so that language was dropped in by the Senate. It reminds me a bit of the "grain glitch" in the Tax Cuts And Jobs Act of 2017. You probably need to be a real tax nerd or a grain farmer to remember that. That was fixed, but this, if it is not what was intended, may be harder to fix.

By the way, there was a reason that I have waited to read the Big Beautiful Bill. Starting in 1984, I deeply studied the proposals which ultimately resulted in the Tax Reform Act of 1986. That one was really big, which is why we still call it the Internal Revenue Code of 1986. TRA 1986 made my career. There was, however, a downside to all that study. In the years after enactment, I would often have ideas pop into my head based on provisions that were not enacted. So now I don't read them till they are signed.