You're reading The Readout newsletter.

You're reading The Readout newsletter.

You're reading The Readout newsletter.

Subscribe below to wrap up every weekday with essential insight on the stories that matter to the UK.

Subscribe below to wrap up every weekday with essential insight on the stories that matter to the UK.

Subscribe below to wrap up every weekday with essential insight on the stories that matter to the UK.

Bloomberg may send me offers and promotions.

Too soon.

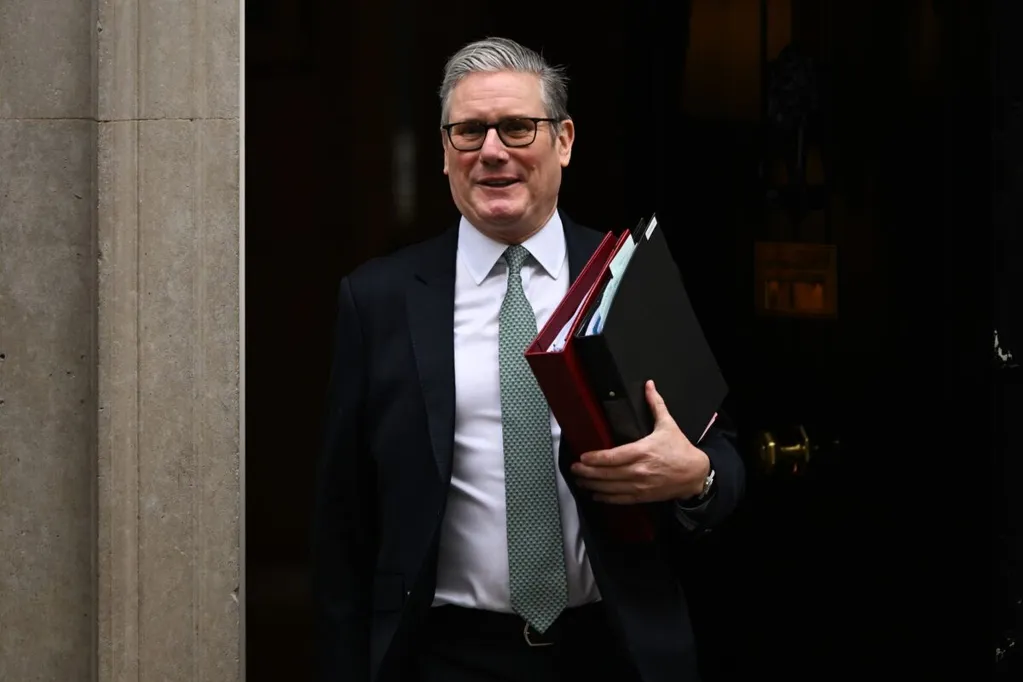

It's too soon to know when Keir Starmer will be off. It's also too soon to know whether AI-induced angst is appropriate, but in the last 24 hours we've seen another "mini sell off."

While Starmer lived to fight another PMQs this lunchtime, few independent analysts think he can survive the coming double electoral trials: first the by-election at the end of the month, then the local and devolved elections at the start of May. The new consensus in Westminster according to our reporters is that Angela Rayner has emerged from the last few days enhanced, but Wes Streeting has been damaged.

The result of that is that we are possibly entering a period of even greater public spending, yet the bond markets are relaxed, clearly still believing it's...too soon to worry.

But even though Starmer is currently getting the benefit of the doubt, some sectors of the economy are most definitely not. In this piece one money manager our reporters spoke to put it like this: "Every company with any sort of potential disruption risk is getting sold indiscriminately."

Just look at this graph:

Nvidia boss Jensen Huang called last week's sell off "illogical" but, Jensen, so said lots of people during lots of sell offs throughout history.

And it's happened again -- this time it was the turn of the wealth management sector after a release from a little known outfit called Altruist, scaring established firms. Bloomberg Opinion's Paul Davies takes a look at whether AI threatens the "finance industry's perpetual profit machine."

"While I mostly suspect that the banking industry's talent for self-preservation will defend it from technological change, I do wonder if the extreme version of our fully automated AI future could make financial services as irrelevant as everything else," he writes.

One idea taking hold, he says, is that money would become entertainment in an AI era: "Prediction markets, gambling with stock options and crypto are just that. The inglorious future of finance could be economically pointless game playing."

The Bloomberg site today is a fascinating dialogue between those fearing how bad a rout could get, and others sensing it's too broad-brush and, with time, opportunities will emerge. Nannette Hechler-Fayd'herbe of Lombard Odier said on Bloomberg TV: "We have held the view that actually it's empowering [software companies]. It is shortening the time for coding, it is enabling efficiencies of workflows. So for us it's actually been an opportunity here to take exposure on a sector that gives also possibilities to invest more on the cloud infrastructure and also on some sub-sectors like cyber-defence."

Bloomberg Opinion's Chris Hughes is also excellent on the opportunities that may be out there: "In the face of a sudden shock like this, investors have little time to sort winners from losers and will sell baskets of stocks exposed to the same theme."

He goes on: "Corporate beneficiaries on the other side of the trade -- businesses that actually use AI to improve how they operate -- could be the more lucrative opportunity."

He looks at how that could work out: "If the market is even half-right to force down the value of software and related industries, the sectors' customers must be set to make corresponding savings or productivity gains that should lead to lower operating costs or higher revenue. It is these 'AI adopters' who represent 'the next phase of the AI opportunity,' according to strategists at UBS Group AG."

AI should drive up productivity and, we all hope, grow the pie. But knowing with any certainty who will still be around to take slices of that pie currently remains beyond the capabilities of even the most advanced LLM...for now.

What just happened

The stories you need to know about this evening

Markets Today: AI Angst

There's both a lot of excitement and worry about the recent advancements in AI. And these are playing out in markets at quite some speed, spreading to sectors beyond tech and markets in which its presence is limited, like in UK stocks.

It seems to be that nearly every day a different pocket of the market is seeing a mini-selloff as the latest launch of an AI tool spooks investors.

Last week a new release from Anthropic sparked a rout across data and analytics firms in a range of sectors such as marketing, legal and financial services.

Yesterday European insurance stocks got snagged in a slide in US insurance brokers following the launch of an AI tool from Insurify. And today, UK-listed wealth managers are feeling the heat after Altruist released a new tax-planning offering within its AI platform.

It looks like, for now, investors are choosing to act first and ask questions later, even as analysts say that the concerns are overblown. And given how fast things are moving in the AI space, expect to see further spates of volatility in sectors.

What they said

"The risk of a leftist turn in the government, particularly under an Angela Rayner-led Labour Party, presents downside risks to the pound and British assets generally."Enrique Diaz-Alvarez

Chief economist at global financial services firm Ebury