This report is from this week's CNBC's The China Connection newsletter, which brings you insights and analysis on what's driving the world's second-largest economy. Each week, we'll explore the biggest business stories in China, give a lowdown on market moves and help you set up for the week ahead.

Just a week after a breakthrough in U.S.-China trade tensions, neither side can yet be confident that the other is holding up their end of the bargain.

"These 90 days won't be smooth," Liu Weidong, research fellow at a state-affiliated think tank, the Chinese Academy of Social Sciences' Institute of American Studies, told me this week. That's according to a CNBC translation of his Mandarin-language remarks.

He predicts elevated uncertainty and smaller steps next, given the already-large breakthrough, as the U.S. and China each try to feel the other out towards a middle ground.

The posturing has already begun.

China's Ministry of Commerce on Wednesday warned that it would take legal action against those involved in assisting or implementing measures to curb the usage of advanced semiconductors from China.

It follows an earlier accusation by the same ministry on Monday that blamed the U.S. for undermining trade talks with a Huawei chip warning last week -- although the U.S. Bureau of Industry and Security had actually toned down its language and dismissed a more restrictive Biden-era plan on chips.

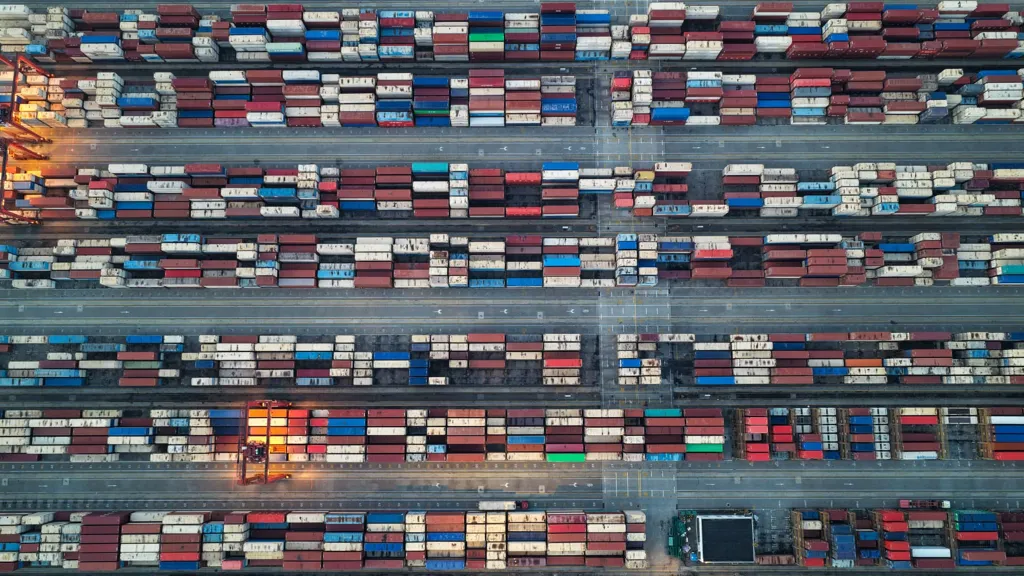

Many in the U.S. are also concerned that China isn't relaxing rare earth export controls, another area in which China dominates the supply chain. That's despite the joint statement's vague description of how China would "suspend or remove the non-tariff countermeasures taken against the United States since April 2, 2025."

"I do think Washington was expecting the export controls on that group of rare earths to be lowered, permitting exports in a relatively unrestricted way," said Scott Kennedy, senior adviser and trustee chair in Chinese Business and Economics at the Center for Strategic and International Studies in Washington, D.C.

"If it turns out that, in fact, that is not the result, the U.S. will probably conclude that China is in violation of the agreement," he said. "We could see a re-escalation sooner rather than later."

While the White House has yet to respond to a CNBC request for comment, a step back reveals ambiguity on China's side.

But are the rare earth export controls part of China's countermeasures to U.S. tariffs? That's up for debate. An April 4 document from China's commerce ministry and customs agency announcing the export controls did not explicitly label them as such.

While China did pause restrictions on 28 U.S. entities that were slapped with export controls on critical minerals, the ministry has made several public statements about strengthening export controls on critical minerals.

"Given the comprehensive and competitive nature of bilateral relations, the current truce -- while focused on trade -- can easily be undermined by export controls," said Yue Su principal economist, China, at The Economist Intelligence Unit.

"While rhetorical posturing is unlikely to undermine the 90-day truce, China may well recalibrate its export control regime in a measured response to U.S. actions," she said.