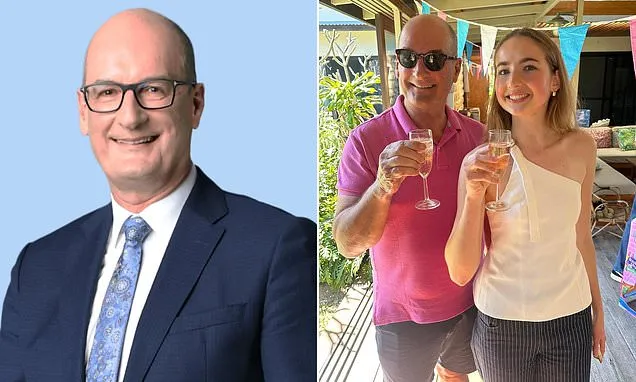

David Koch has urged fellow baby boomers to rethink how much wealth they hand over to their children, warning that overly generous gifts could put their own retirement lifestyle at risk.

Koch said he's increasingly worried many boomers are giving away more money than they can afford, potentially undermining their financial security in later life.

'Nobody wants to see their children struggle,' Koch said in a Yahoo column published this week.

'But I'm a little concerned that guilt-ridden baby boomer parents could end up putting their retirement lifestyles at risk, by digging a little too deep.'

The Compare the Market economic director explained that compulsory superannuation, now at 12 per cent, means many boomer children will retire with 'triple the amount you have'.

'When we Baby Boomers started, it was set as a miserly 3%. Then it went to 4%, then 6%, but it took ages to get to the levels we now enjoy today.

'Young people today are going to benefit from contribution rates now set at 12% their entire working life. If your kids have good jobs and keep working, they could retire with triple the amount you have.

'So don't compromise your retirement and your life just because your kids are putting pressure on you to help them build their own,' he said.

Koch expressed concern boomers were giving away too much cash to their kids which placed their own retirement lifestyle in jeopardy.

'You have got to let them work it out. You owe your kids a good education, a stable family life and a good upbringing.

'You shouldn't feel obliged to pass on money before you die, especially if it affects your retirement life.'

Koch said according to CoreData, around $4.9 trillion is set to be passed on from boomers to their children, grandchildren and charitable benefactors over the next decade.

'It's extremely generous, but personally I don't think you owe your kids any sort of inheritance,' Koch said.

'While you understandably want to give your kids a big leg up, just remember, your life matters too. Take happiness in buckets, until you kick the bucket.'

However, Koch did acknowledge kids today have a harder time buying a home than his generation but he said it's a 'cycle'.

'While this generation does face a bigger challenge getting into the property market, there have always been struggles,' he said.

'I was envious of my parent's lifestyle when I bought my first home because it was a real slog with much higher interest rates.'

Koch did acknowledge kids today have a harder time buying a home than his generation but he said it's a 'cycle'.

'While this generation does face a bigger challenge getting into the property market, there have always been struggles,' he said.

'I was envious of my parent's lifestyle when I bought my first home because it was a real slog with much higher interest rates.'

'At times we hardly left the house. We couldn't afford to eat out at restaurants when our repayments were so big.'

'Now the tables have turned, and my kids are envious of me! It is a bit of a cycle, and I reckon we need a little more faith in the process.'

Comparison site Finder released data this year showing 17 per cent of first-home buyers needed financial help from their parents to save a deposit.

It also found that buyers who received parental support ended up with 41 per cent more money left over in savings than those who didn't.

The report revealed 40 per cent of first-home buyers without family help took five years or more to save a deposit, compared with just 29 per cent of those who did receive assistance.

Meanwhile, new figures from Colonial First State show Australians aged 18 to 29 expect to inherit an average of $525,000.

But Colonial First State technical services boss Craig Day warned those expectations are likely to be squeezed.

'Older Australians are facing longer lifespans and higher aged-care costs, so that $525,000 expectation is going to come under a lot of pressure,' Mr Day.

'Many assets earmarked for inheritance may end up being needed elsewhere.'

Colonial First State added that while most older Australians intend to leave something behind, many underestimate how much they will actually have left after funding their own retirement and care needs.