Rachel Reeves' Budget will have a huge impact on Britons from all walks of life.

From keeping income tax thresholds frozen for another three years and dragging millions more into higher tax, to raiding salary sacrifice on pensions and introducing a mansion tax for high-value homes, our finances are being hit from all sides.

There were also raids on electric car drivers, Isa savers and even those who enjoy the odd milkshake.

The Chancellor also handed out some cash, scrapping the two-child benefit cap and cut a green levy which could save people money on their energy bills.

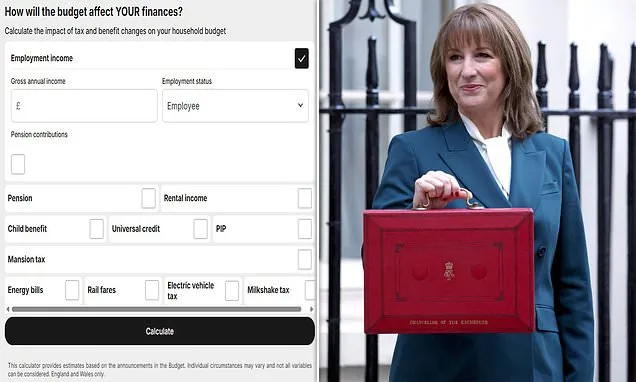

But what does it mean for you? Our comprehensive calculator allows you to enter your personal income, outgoings, bills and more to find out, in pounds and pence, the impact the Budget will have on your money.

It then provides you with an in-depth breakdown of exactly how much each measure will cost you.

Input your details using the calculator below, and click 'calculate' to start.

You can also see a round-up of all the key news from the Budget below.

How the Budget will affect you - essential reading

- Cash Isa allowance slashed to £12,000 for under 65s

- Rachel Reeves hikes savings interest tax - and hits investors too

- Budget salary sacrifice blow to pension savers, what will it cost YOU?

- State pension will rise 4.8% to £12,548 a year next April, Chancellor confirms

- M+ exclusive What Reeves' devastating pensions raid means for you

- Fuel duty frozen and 5p cut extended as Chancellor spares drivers for now

- Pension tax-free cash SAVED (for now) in the Budget

- Britain faces five years of stagnating living standards as inflation and tax bite

- Green levies on energy bills scrapped but Reeves opts against cutting VAT

- Reeves to extend scheme which boosts savings on low incomes

- Mansion tax: Council tax surcharge to hit homes worth more than £2M

The income tax freeze

Rachel Reeves' biggest tax hike was a stealth one, freezing income tax thresholds for another three years after they were due to start rising with inflation.

The tax-free personal allowance after which 20 per cent basic rate tax is charged will remain at £12,570 until 2031.

The higher rate threshold, at which income tax steps up to 40 per cent tax will stick at £50,270.

The additional rate threshold, above which income tax goes up again to 45 per cent will stall at £125,140.

Tax bands have been frozen since 2021 and this has already cost workers and other taxpayers a huge amount.

As an example, consumer prices inflation has been 27 per cent since then, meaning that someone on the cusp of higher rate tax earning £50,000 whose earnings rose with inflation would have had a £13,500 pay boost to £63,500

If tax thresholds had kept pace with inflation, they would only have paid 20 per cent income tax on that, but the freeze means they have paid 40 per cent, which will cost them an extra £2,700 in tax this year.

The chancellor also announced freezes in the National Insurance thresholds, which will counterintuitively help middle-to-high earners.

This is because NI rates are regressive, with all income between £12,570 and £50,270 being taxed 8%, but all income higher than that having the lower rate of 2%.

This means that a greater proportion of your income ends up in the lower band.

Reeves also announced a freeze on thresholds for the repayment of Plan 2 student loans, paid for by those who started university between September 2012 and July 2023.

Above the threshold, currently at £28,470, graduates pay 9% of their income in repayments.

This will rise to £29,385 next year and be frozen until 2030, costing hundreds a year.

Low earners are likely to be pushed up to the repayment threshold, as the OBR expects a full-time minimum wage earner to be on £28,995 by 2030, just £400 away from having to make repayments.