All across the country, lawmakers from both sides of the political spectrum are staring down at strained budgets and considering their options to keep state finances afloat and continue funding key public services.

But while 14 states are now facing the same question of how to fill projected budget deficits for the next fiscal year, their answers have been radically different.

Some states are looking to cut spending or impose hiring freezes; others are tapping rainy-day funds and tweaking taxes. But a few are looking into an option that has become divisive in the country in recent years: increasing taxes on the ultra-wealthy.

The wealth gap between America's poorest and richest has widened over the past several years, with the pandemic turbocharging gains for the super-rich while leaving pretty much anyone else behind.

The richest 1 percent in the country accumulated almost 1,000 times more wealth than the poorest 20 percent over the last three and a half decades, according to a study released by Oxfam late last year.

Between 1989 and 2022, according to Oxfam, a household in the top 1 percent gained $8.35 million in wealth, while one in the 0.1 percent -- the richest among the rich -- gained $39.5 million. By comparison, a household in the bottom 20 percent gained less than $8,500 during the same period.

This surge in inequality in the U.S. has pushed many to call for higher taxes -- including some 400 millionaires and billionaires from 24 countries who recently wrote an open letter urging global leaders to raise taxes on the super-rich and curb their growing political influence.

But while some lawmakers have expressed support for higher taxes on the super-rich, which they say will help continue funding public schools, roads, and emergency services, others are wary of the impact it could have on their state's economy if wealthy residents decided to up and leave to avoid paying bigger bills.

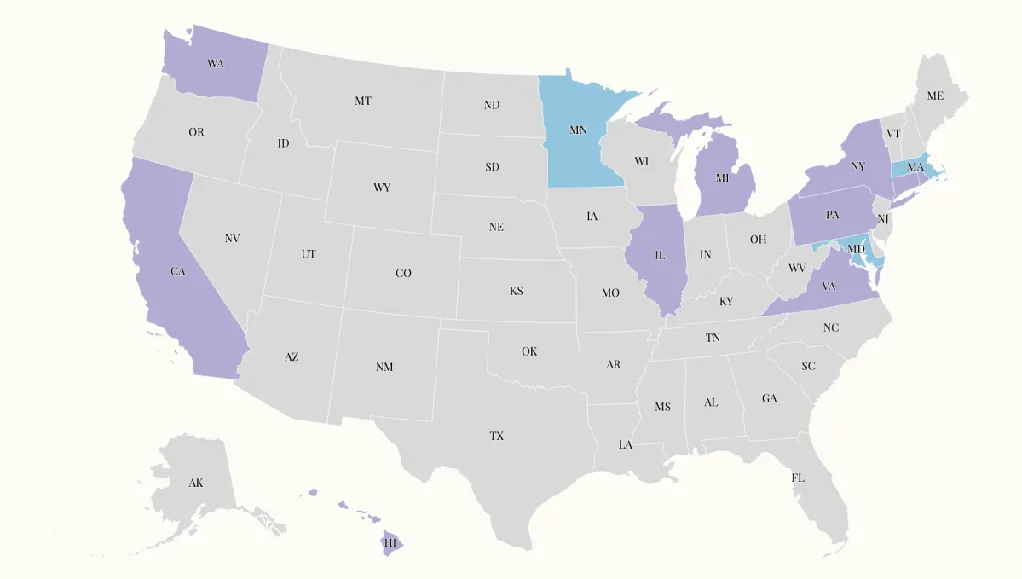

A proposed ballot measure, which organizers hope will reach California voters this November, is the 2026 Billionaire Tax Act, which would impose a "one-time" 5 percent tax on the wealth of high-net-worth individuals who resided in California as of January 1, 2026.

The move has been presented as a way to raise $100 billion in revenues without hurting everyday Californians.

But the idea, while popular among some, has received backlash from Governor Gavin Newsom, who has expressed concern over its potential to harm the state's competitiveness and fears that such a measure would lead to an exodus of wealthy residents.

"We're competing with 50 states," Newsom said at the World Economic Forum in Davos, Switzerland, last month. "Capital flows and move(s). That's real. It's not imagined. It's very, very real."

In Connecticut, lawmakers are now reviving efforts to enact a 1.75 percent surcharge on capital gains for individuals earning over $1 million and couples earning over $2 million, which failed to pass through the legislature last year. House Bill 5185 has been introduced by 34 Democrats and referred to the legislature's Finance, Revenue and Bonding Committee, even though it is opposed by state Governor Ned Lamont, also a Democrat.

Hawaii lawmakers introduced a measure last year, Senate Bill 313, which would levy a 1 percent tax on net assets above $20 million, covering holdings such as real estate, stocks, bonds, cash, and collectibles. While it passed the state Senate Judiciary Committee early last year, the bill was carried over to the 2026 regular session and is yet to be signed off.

Chicago Representative LaShawn Ford, a Democrat serving Illinois' 8th House District, has recently introduced a proposal for a constitutional amendment, Illinois House Joint Resolution Constitutional Amendment 26, which would put a 3 percent surtax on any income residents make beyond $1 million.

This surtax would exist alongside Illinois' existing 4.95 percent flat income tax rate and revenues obtained through it would go "to provide property tax relief," the proposal states.

The amendment would need to be backed by three-fifths of both the state House and the Senate before being put in front of voters.

A new proposed ballot initiative, "Invest in MI Kids," would add a 5 percent additional tax on high earners (over $500,000 for single filers, $1 million for joint filers), with revenue earmarked for education.

Supporters say it would raise about $1.7 billion a year for public education and make the state's regressive tax system fairer for residents.

New York City Mayor Zohran Mamdani has proposed a 2 percent tax increase on individuals earning over $1 million as part of a plan to address a projected $12 billion gap in the city budget.

If such a measure is not introduced, he said he may have to resort to raising property taxes for New Yorkers -- a measure that he admitted would hurt low- and middle-income residents.

But the threat to increase property taxes is being interpreted by experts as a way to put pressure on Governor Kathy Hochul to introduce higher taxes on the state's ultra-wealthy -- something that she has been opposed to.

Twenty Pennsylvania lawmakers backed the "Tax Billionaires, Fund PA" plan at the end of 2025, a package projected to raise roughly $4 billion through closing corporate tax loopholes, enacting a digital advertising tax, and taxing billionaire passive income.

Rhode Island Governor Dan McKee has included in its proposed budget for fiscal year 2027 a plan to add a 3 percent surtax on state income over $1 million. If passed, the increase would make the state's income tax rate the second-highest in New England after Massachusetts.

According to McKee, the surtax would generate an estimated $67 million in revenue in fiscal year 2027 and $135 million by fiscal year 2028.

Virginia lawmakers have introduced two bills, HB 378 and HB 979, which would increase taxes on certain forms of investment income by 3.8 percentage points and create two new individual income tax rates on high earners at 10 percent and 8 percent, respectively.

If both bills were to pass during this legislative session, Virginia would have the nation's highest top marginal rate on investment income, according to the Tax Foundation.

Lawmakers in Washington state have advanced a proposed "millionaires tax" that would impose a 9.9 percent tax on income above $1 million, marking a major shift for a state without a traditional income tax.

The measure passed the state Senate this month and is under active debate in the House.

Massachusetts voters approved a 4 percent tax hike on income over $1 million in 2022, which took effect in 2023 and has since generated billions in additional revenue for education and transportation. This tax is now often cited as a model by other states trying to follow Massachusetts' example.

Last year, Maryland Governor Wes Moore signed the fiscal year 2026 budget bill into law, which included a new tax bracket for households earning more than $1 million, alongside higher capital‑gains taxes on top earners.

The changes raised the tax rate to 6.25 percent for household income between $500,001 and $1 million, and to 6.5 percent for households earning over $1 million. The spending plan also added a 2 percent capital gains surcharge for income over $350,000.

Minnesota adopted a 1 percent tax on net investment income above $1 million beginning in tax year 2024, targeting capital gains, dividends, and other investment income rather than wages.